Indians embrace e-payments, but prefer security to discounts

Indians are among the most open in the Asia-Pacific region to using emerging digital payment methods, with 93% consumers likely to have used at least one mode of digital payment in the past year, showed a new survey commissioned by Mastercard.

Only the Chinese did better (98%), showed the survey conducted over March and April among 7,004 adults evenly distributed across seven markets.

View Full Image

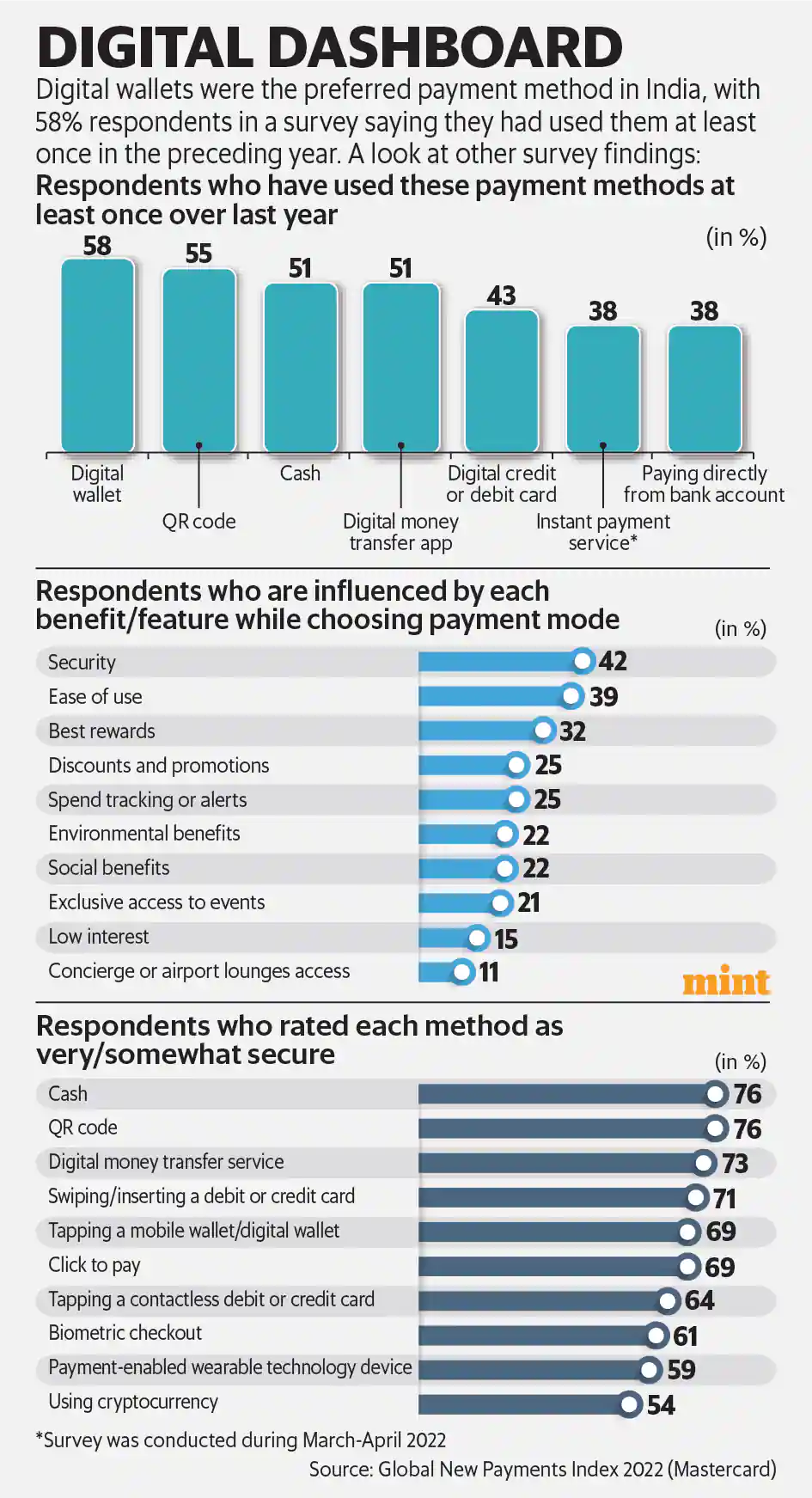

In India, digital wallets were the preferred payment method, with 58% saying they had used them at least once in the preceding year. The usage was even higher among the affluent (64%) and millennial (63%) respondents.

Among Indians, other emerging methods such as QR codes and digital money transfer apps also had over 50% share. Cash was the third most favoured method with a 51% adoption, while other traditional modes such as in-person credit, debit, or pre-paid card or contactless card had less than a one-third share.

Respondents could pick multiple options.

The survey had 52% male respondents and 48% females. In terms of age group, it comprised 37% Gen-Z (age 18-25), 48% millennials (age 26-43), and the rest older. The survey’s findings—‘Global New Payments Index’—were shared exclusively with Mint.

Indian consumers are making purchases in diverse ways, with a range of digital purchasing…