Russia’s Ukraine Invasion Poses Big Economic Risks, Including Fed Policy, Oil Prices, Cybersecurity

Russia’s Ukraine invasion began early Thursday, igniting a new Cold War amid already-heightened U.S. and global economic risks.

X

President Joe Biden and U.S. allies retaliated with a barrage of sanctions. Yet Biden made clear on Thursday that those sanctions are tailored to degrade Russia’s military and economic potential over the long term, while shielding the U.S. and Europe from a near-term blowback.

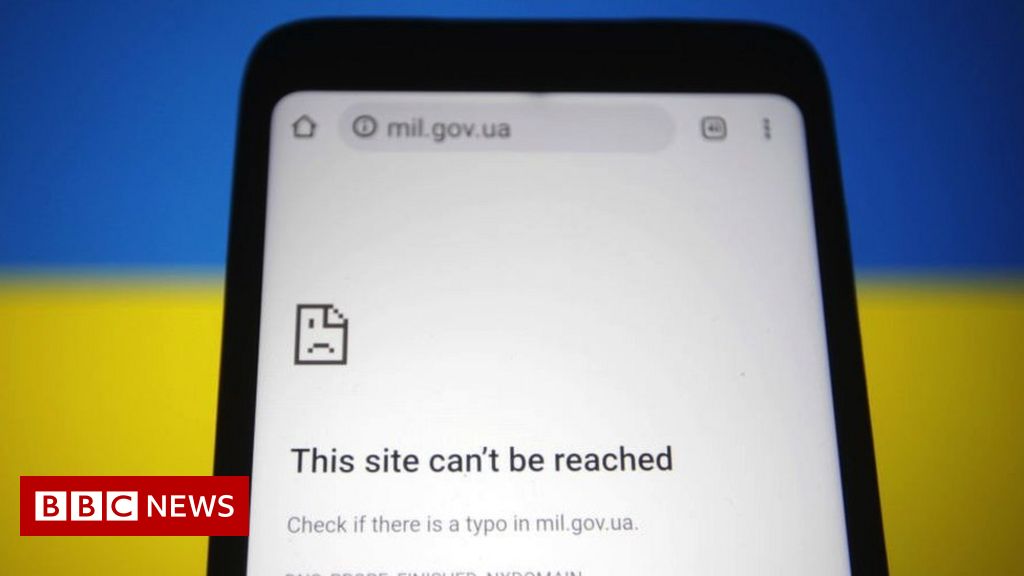

That’s why, despite a new era of heightened geopolitical risk and potentially intensified cybersecurity warfare, Wall Street reacted like the global economy had dodged a bullet.

The major indexes tumbled Thursday morning to their lowest levels in months as Russian President Vladimir Putin began his full-blown Ukraine invasion. But stocks rebounded powerfully by the close and added to gains Friday, with cybersecurity plays such as Palo Alto Networks (PANW) leading the way. A new stock market rally attempt is underway but has not been confirmed.

Yet serious risks for the U.S. and global economies remain.

Federal Reserve Economic Risks

If nothing else, a protracted Ukraine invasion could add a premium to oil prices because of the greater chance that some of Russia’s indispensable crude supply could be shelved. The price of oil briefly topped $100 a barrel Thursday. It’s now eased back to above $91 — still the highest since 2014.

If nothing else, a protracted Ukraine invasion could add a premium to oil prices because of the greater chance that some of Russia’s indispensable crude supply could be shelved. The price of oil briefly topped $100 a barrel Thursday. It’s now eased back to above $91 — still the highest since 2014.

While soaring energy prices might dampen consumer spending, they could send the CPI inflation rate past 8%. That might compel the Federal Reserve to plow ahead with its plan to aggressively tighten monetary policy, even if economic growth might sputter.

“If anything, this aggravates the inflation problem in the U.S.,” Krishna Guha, vice chairman of Evercore ISI, told firm clients in a Thursday webinar on the implication of Russia’s invasion. “It makes it harder to achieve the soft landing” the Fed is trying to execute.

In the past, a geopolitical crisis triggering a market correction would spur the Fed to put off rate hikes.

Goldman Sachs economists note that the Fed moved to ease policy after 9/11 and as China trade war tensions spiked. Yet this time is different. “Inflation risk has created a stronger and more urgent reason to tighten today,”…