The HACK Cybersecurity ETF in Focus

The ETFMG Prime Cyber Security ETF (HACK) is likely to continue enjoying increased investor interest as long as cyber defense remains an integral part of a business’s security measures—and it appears as though it will. According to a report by Global Market Insights, the cybersecurity market has an expected compound annual growth rate of 15% through 2032 and is forecast to reach a market size of about $900 billion.

Learn more about the HACK ETF and see what’s in store for the cyber defense securities market.

Key Takeaways

- The HACK ETF invests in companies that create cybersecurity solutions.

- Spending on cybersecurity is expected to grow rapidly, with a CAGR forecasted to be as much as 15% through 2032.

- Cyber attacks on the U.S. government and businesses continue to make headlines, fueling growth expectations as the world migrates more to a digital landscape.

HACK ETF Overview

The HACK ETF, sponsored by ETF Managers Group LLC, or ETFMG, invests in companies that offer hardware, software, and services in the cybersecurity field. It is designed to track the performance of the Prime Cyber Defense Index (PCYBER), which includes “companies providing cybersecurity solutions that include hardware, software, and services.”

The fund launched in Nov. 2014, and as of Jan. 23, 2024, it has assets under management (AUM) of $1.7 billion.

Top Holdings

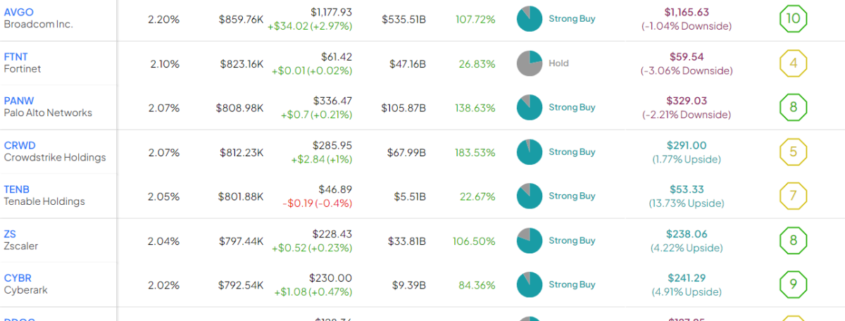

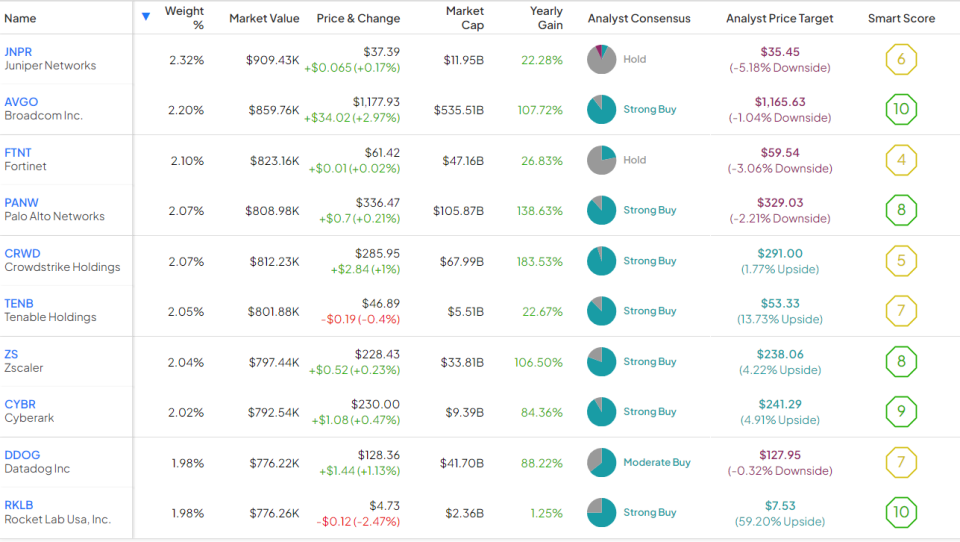

The fund has a total of 48 holdings. The top 10 holdings as of Jan. 23, 2024, are:

- CrowdStrike Holdings Inc. (CRWD)

- Zscaler Inc. (ZS)

- Fortinet Inc. (FTNT)

- Palo Alto Networks Inc. (PANW)

- BAE Systems Plc. (BAESY)

- Cloudflare Inc. (NET)

- Check Point Software Tech Ltd. (CHKP)

- Gen Digital Inc. (GEN)

- Cisco Systems Inc. (CSCO)

- Okta Inc. (OKTA)

Performance

As of Dec. 31, 2023, the fund had a one-year performance of 37.42%, a three-year performance of 1.91%, and a five-year performance of 12.92%. Since its inception, the fund has a performance of 10.64%.

As of Jan. 22, 2024, HACK closed at $63.39. The stock dropped significantly at the end of 2021 during the COVID-19 pandemic and continued to fall throughout 2022. The share price started to gain traction again in 2023 and took off in Oct. 2023.