California man says fraudulent accounts opened, home purchased in his name since city of Oakland ransomware attack

OAKLAND, Calif. — It’s been ten months since the city of Oakland, California’s network was hacked and the personal information of tens of thousands of people was leaked onto the dark web. Now, one victim says multiple accounts have been opened in his name, making fraudulent purchases, including a house.

Our sister station KGO was the first to report the city’s oversight — exposing dozens of victims who were never notified that their sensitive financial information was leaked.

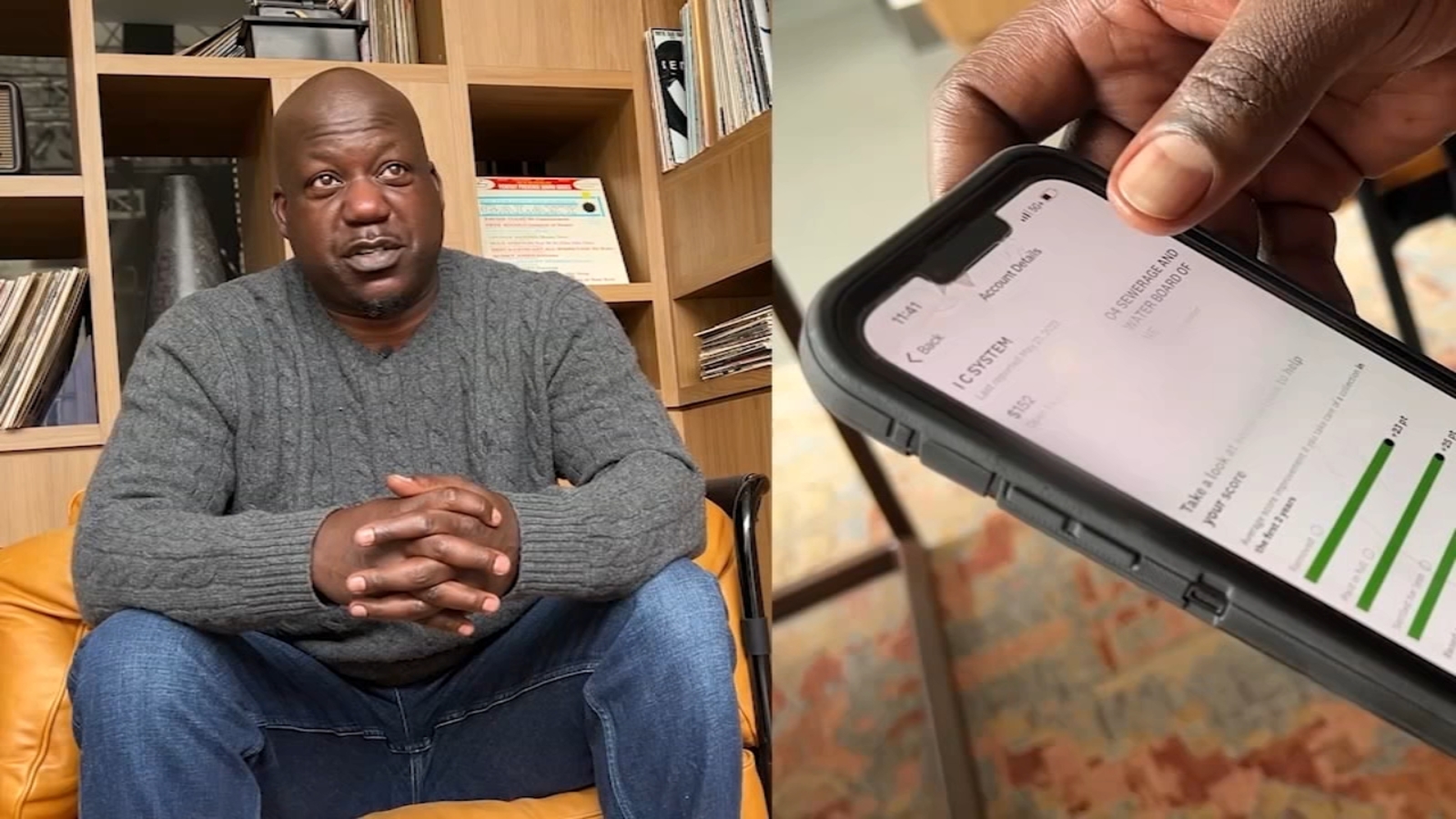

“It’s a living nightmare,” said Oakland native Dedrick Warmack, as he anxiously checked his mailbox. “On the credit report, there’s credit cards that should’ve been closed, they’re now open with balances of $17,000 and $30,000.”

VIDEO: Dozens of Oakland ransomware victims never notified SSN were leaked on dark web

Dozens of victims of Oakland ransomware hack were never notified their social security numbers were leaked on the dark web, the I-Team found.

Warmack says his identity was stolen months after the city’s network was hacked.

“I have no idea how many accounts have been opened in my name,” he said.

Warmack says his credit score dropped more than 200 points, but he didn’t know at the time that was just the beginning.

At first, he says he started receiving strange phone calls and emails about refinancing a home. That was followed by letters he says he got from several banks notifying him of new accounts in his name.

“I knew something was going on,” he said.

Warmack is one of dozens of victims who previously filed a claim with the city alleging injury, but instead, ended up with their personal and financial information leaked.

Now, he says fraudulent checks are being made in his name.

RELATED: Oakland ransomware attack: Leaked data has more than 3.1K views on dark web

“Like this water and sewage bill for $2,000,” Warmack showed as he scrolled through his accounts. “This is not East Bay Mud…”

Warmack says some of the bills appear to be from New England.

“It says it’s an open balance, how can I have an open balance?”

From there — he says it only got worse.

“I’m getting notices about refinancing a home… and I’m like, I pay rent,” said Warmack. “Somebody has something in my name somewhere since October, I’ve been…