IRS To Ditch Biometric Requirement for Online Access – Krebs on Security

The Internal Revenue Service (IRS) said today it will be transitioning away from requiring biometric data from taxpayers who wish to access their records at the agency’s website. The reversal comes as privacy experts and lawmakers have been pushing the IRS and other federal agencies to find less intrusive methods for validating one’s identity with the U.S. government online.

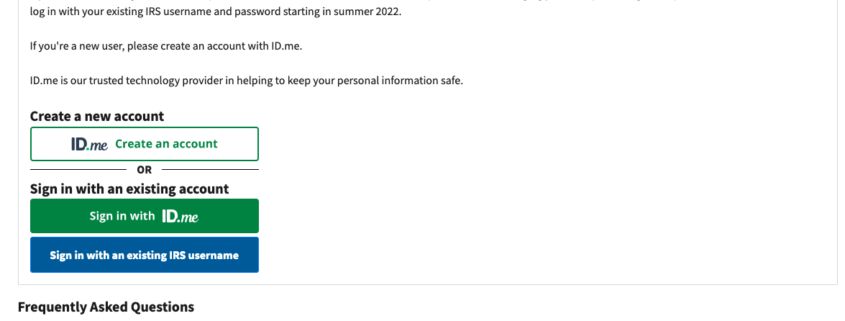

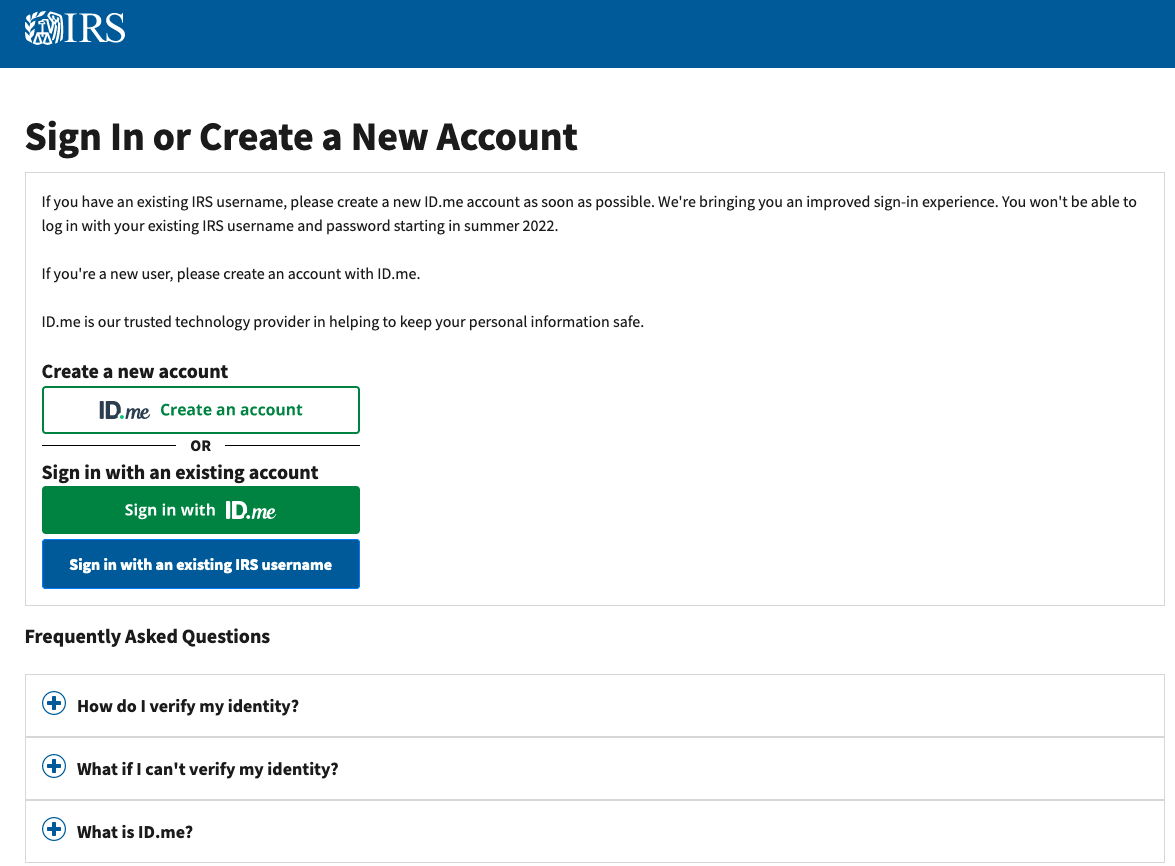

Late last year, the login page for the IRS was updated with text advising that by the summer of 2022, the only way for taxpayers to access their records at irs.gov will be through ID.me, an online identity verification service that collects biometric data — such as live facial scans using a mobile device or webcam.

The IRS first announced its partnership with ID.me in November, but the press release received virtually no attention. On Jan. 19, KrebsOnSecurity published the story IRS Will Soon Require Selfies for Online Access, detailing a rocky experience signing up for IRS access via ID.me. That story immediately went viral, bringing this site an almost unprecedented amount of traffic. A tweet about it quickly garnered more than two million impressions.

It was clear most readers had no idea these new and more invasive requirements were being put in place at the IRS and other federal agencies (the Social Security Administration also is steering new signups to ID.me).

ID.me says it has approximately 64 million users, with 145,000 new users signing up each day. Still, the bulk of those users are people who have been forced to sign up with ID.me as a condition of receiving state or federal financial assistance, such as unemployment insurance, child tax credit payments, and pandemic assistance funds.

In the face of COVID, dozens of states collectively lost tens of billions of dollars at the hands of identity thieves impersonating out-of-work Americans seeking unemployment insurance. Some 30 states and 10 federal agencies now use ID.me to screen for ID thieves applying for benefits in someone else’s name.

But ID.me has been problematic for many legitimate applicants who saw benefits denied or delayed because they couldn’t complete ID.me’s verification process. Critics charged the…