Fidelity National Financial hack highlights why many are increasingly concerned about cybersecurity

Recently, Fidelity National Financial, a Fortune 500 provider of title insurance for buyers and sellers, was hit by a devastating cyber attack.

Fidelity National Financial submitted regulatory documents to the U.S. Securities and Exchange Commission acknowledging the attack on Nov. 21, 2023, describing how it handled the situation. “Among other containment measures, we blocked access to certain of our systems, which resulted in disruptions to our business. For example, the services we provide related to title insurance, escrow and other title-related services, mortgage transaction services, and technology to the real estate and mortgage industries, have been affected by these measures.”

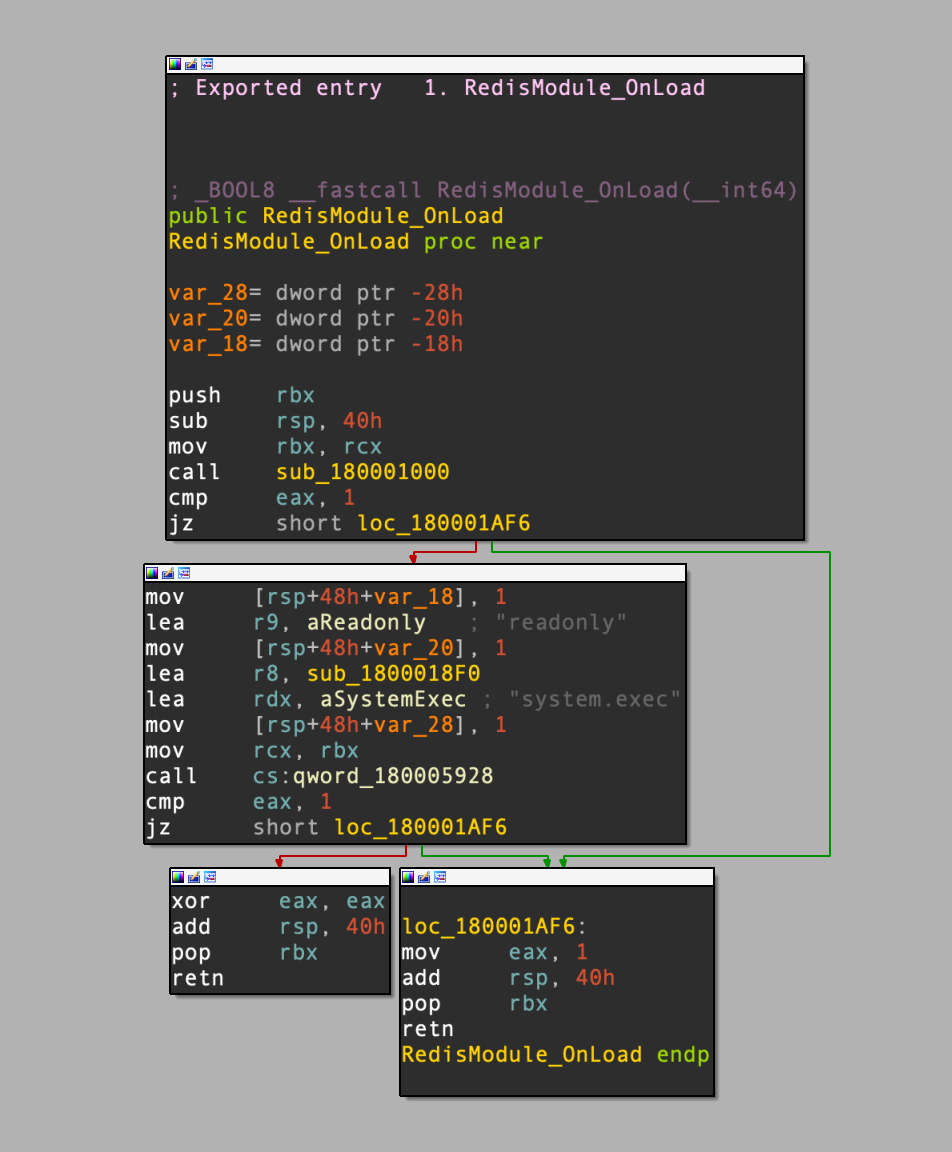

The next day, AlphV/Black Cat ransomware gang claimed credit.

On Nov. 30, 2023, FHF submitted an updated filing to the SEC regarding the attack. “The incident was contained on November 26, 2023. The company is restoring normal business operations and is coordinating with its customers.” As we write this, a week after FNF initially acknowledged the attack, Fidelity National Financial’s website is finally back online. The company hasn’t said whether it paid a ransom to restart its systems. While its website may be back online, many of its title company and settlement agent services were, at the time, still suffering an outage.

Regardless, the hack compromised the ability for the title company to close deals for its buyer and seller customers over the Thanksgiving weekend. For most people, when you buy or sell a home, you’re closing on the single biggest financial transaction of your life. Having that go awry can cause confusion, concern and even panic.

The FNF hack also highlights why so many in the financial services industry are increasingly concerned about cybersecurity. On its website, FHF has a link to a page discussing its “Commitment to Helping Combat Wire Fraud” and another to “potentially fraudulent employment offers.”

Business Email Compromise (BEC) is one way wire fraud happens in real estate. A hacker targets employees of a business. They send phishing emails that look real enough for someone in the business to click on them. The hacker then gains access to that…