HACK: No Recession In Cybersecurity (NYSEARCA:HACK)

MF3d

As most all of you know, cybersecurity is no longer a discretionary expense. Governments, businesses large-n-small, and consumers all require protection from the rogue state actors – as well as individual hackers and groups – that are trying to compromise their cyber-operations. Just today it was reported that a whistleblower who used to be the head of security at Twitter (TWTR) alleged the company “has major security problems that pose a threat to its own users’ personal information, to company shareholders, to national security, and to democracy.” Twitter has downplayed the allegations, but we all remember when President Biden, Elon Musk, Bill Gates, and Warren Buffett’s Twitter accounts were hacked back in 2020. The point is that no one, no company, and no government is immune from cybersecurity threats. That being the case, investors should consider allocating some capital to the fast growing cybersecurity sector. Today I will take a look at the ETMG Cybersecurity ETF (NYSEARCA:HACK) to see if it is a good option for diversified exposure to the sector.

Investment Thesis

Fortune Business Insights estimates the global cybersecurity market will grow at a 13.4% CAGR through 2029 and will exceed $376 billion at the end of that time frame. Growth will be driven by the proliferation of E-commerce platforms as companies and governments continue to embrace the digital transformation. All the links of the digital world – high-speed networking, cloud-computing, data centers, AI/ML, blockchain, etc. – need end-to-end cybersecurity protection. Read more about growing cybersecurity threats here.

The cybersecurity sector is fertile ground for investors so today I will take a close look at the HACK ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

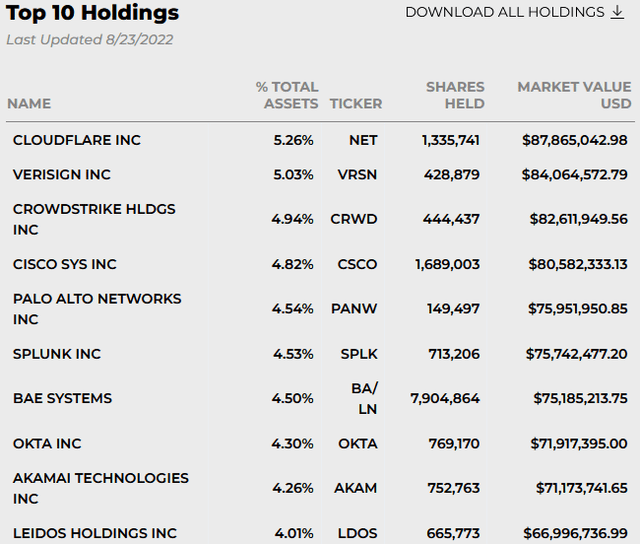

The top-10 holdings in the HACK ETF are shown below and equate to what I would generally consider to be a moderately-diversified 46% of the entire 63-company portfolio.

Source: ETFMG HACK Webpage

HACK’s #1 holding is Cloudflare (NET) with a 5.3% weight. NET surged 26% earlier this month on strong earnings (revenue up 54% yoy) and upbeat guidance wherein even the low-end of FY22 revenue guidance ($968…