Coinbase hangover rattles crypto assets with bitcoin in free fall, Telecom News, ET Telecom

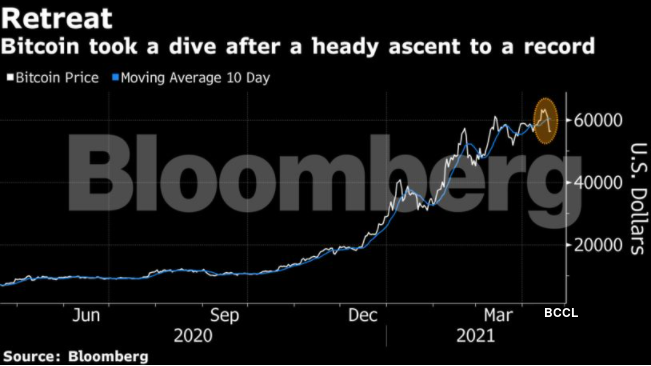

The mania that drove crypto assets to records as Coinbase Global Inc. went public last week turned on itself on the weekend, sending Bitcoin tumbling the most since February.

The world’s biggest cryptocurrency plunged as much as 15% on Sunday, just days after reaching a record of $64,869. It subsequently pared some of the losses and was trading at about $56,440 at around 8:25 a.m. in Tokyo Monday.

Ether, the second-biggest token, dropped as much as 18% to below $2,000 before also paring losses. The volatility buffeted Binance Coin, XRP and Cardano too. Dogecoin — the token started as a joke — bucked the trend and is up 7% over 24 hours, according to CoinGecko.

The weekend carnage came after a heady period for the industry that saw the value of all coins surge past $2.25 trillion amid a frenzy of demand for all things crypto in the runup to Coinbase’s direct listing on Wednesday. The largest U.S. crypto exchange ended the week valued at $68 billion, more than the owner of the New York Stock Exchange.

“With hindsight it was inevitable,” Galaxy Digital founder Michael Novogratz said in a tweet Sunday. “Markets got too excited around $Coin direct listing. Basis blowing out, coins like $BSV, $XRP and $DOGE pumping. All were signs that the market got too one way.” Dogecoin, which has limited use and no fundamentals, rallied last week to be worth about $50 billion at one point before stumbling Saturday. Demand was so brisk for the token that investors trying to trade it on Robinhood crashed the site a few times Friday, the online exchange said in a blog post.

Dogecoin, which has limited use and no fundamentals, rallied last week to be worth about $50 billion at one point before stumbling Saturday. Demand was so brisk for the token that investors trying to trade it on Robinhood crashed the site a few times Friday, the online exchange said in a blog post.

There was also speculation Sunday in several online reports that the crypto plunge was related to concerns the U.S. Treasury may crack down on money laundering carried out through digital assets. The Treasury declined to comment, and its Financial Crimes Enforcement Network (FinCEN) said in an emailed response on Sunday that it “does not comment on potential investigations, including on whether or not one exists.”

‘Price to Pay’

“The crypto world is waking up with a bit of a sore head today,” said Antoni Trenchev, co-founder of crypto lender Nexo. “Dogecoin’s 100% Friday rally…