Tarrant Appraisal District extends protest deadline after ransomware attack

Disagree with the Tarrant Appraisal District’s valuation of your residential property? You now have until May 24 to protest it.

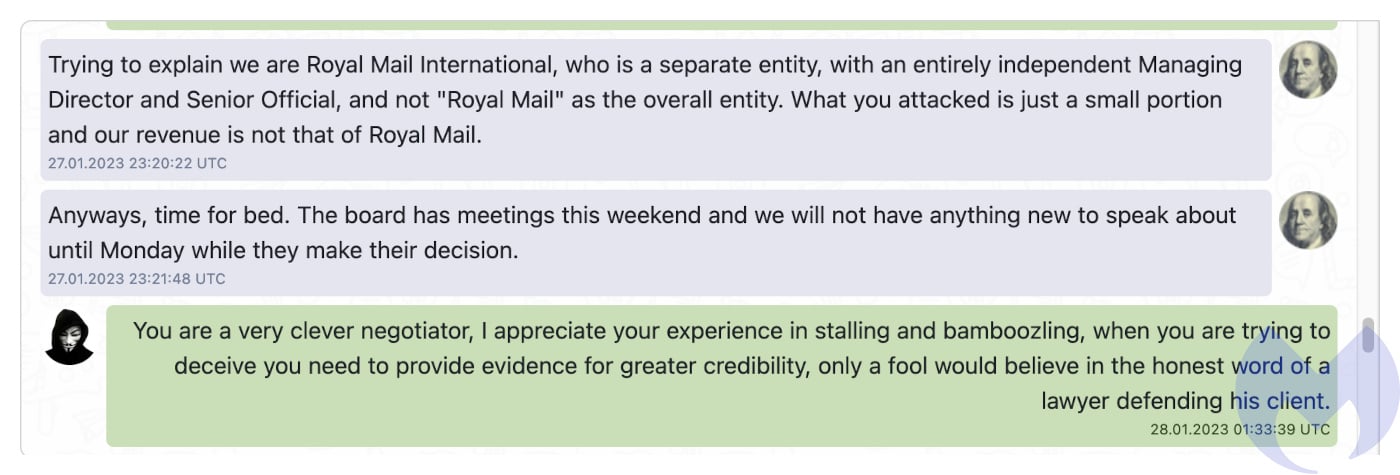

District officials extended the deadline from May 15 after a ransomware attack at the end of March forced systems offline, delaying access to its online protest tool in the process. The group responsible for the attack, Medusa, posted taxpayer information online after the district refused to pay the ransom. Since then, the appraisal district’s essential services are back online and the board approved new funding for cybersecurity measures.

The new deadline allows residents 30 days from the time the online protest function was restored to challenge an appraisal. People can access the online protest function by logging in, heading to their dashboard and clicking the protest button on the left-hand side of the screen.

There are multiple reasons residents can protest, including concerns about incorrect valuations, tax exemptions being denied and incorrect owner or property information. The protests will be considered by the appraisal review board, which schedules hearings to review evidence and determine whether the district erred in its appraisal decision.

Commercial appraisal notices are expected to be mailed May 1, and the deadline to protest these appraisals is May 31 or 30 days from the mailing date, whichever is later.

Before then, voters will head to the polls May 4 to elect three at-large appraisal district board members. Board members do not determine protests or property appraisals.

Emily Wolf is a government accountability reporter for the Fort Worth Report. Contact her at [email protected]At the Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our editorial independence policy here.

This article first appeared on Fort Worth Report and is republished here under a Creative Commons license.