Online Payment Security Tips That Everyone Should Know

In this digital age, more and more people are making purchases online. This is great for consumers because it means that they have a wider range of choices when it comes to products and services. With just a couple of clicks, you can get food, clothes, video games, and anything else delivered to your door.

This trend is also great for businesses because it allows them to reach a larger audience. However, with this increased convenience also comes an increased risk of fraud and identity theft. That’s why everyone needs to know some basic online payment security tips…many of which we’re going to cover in this article.

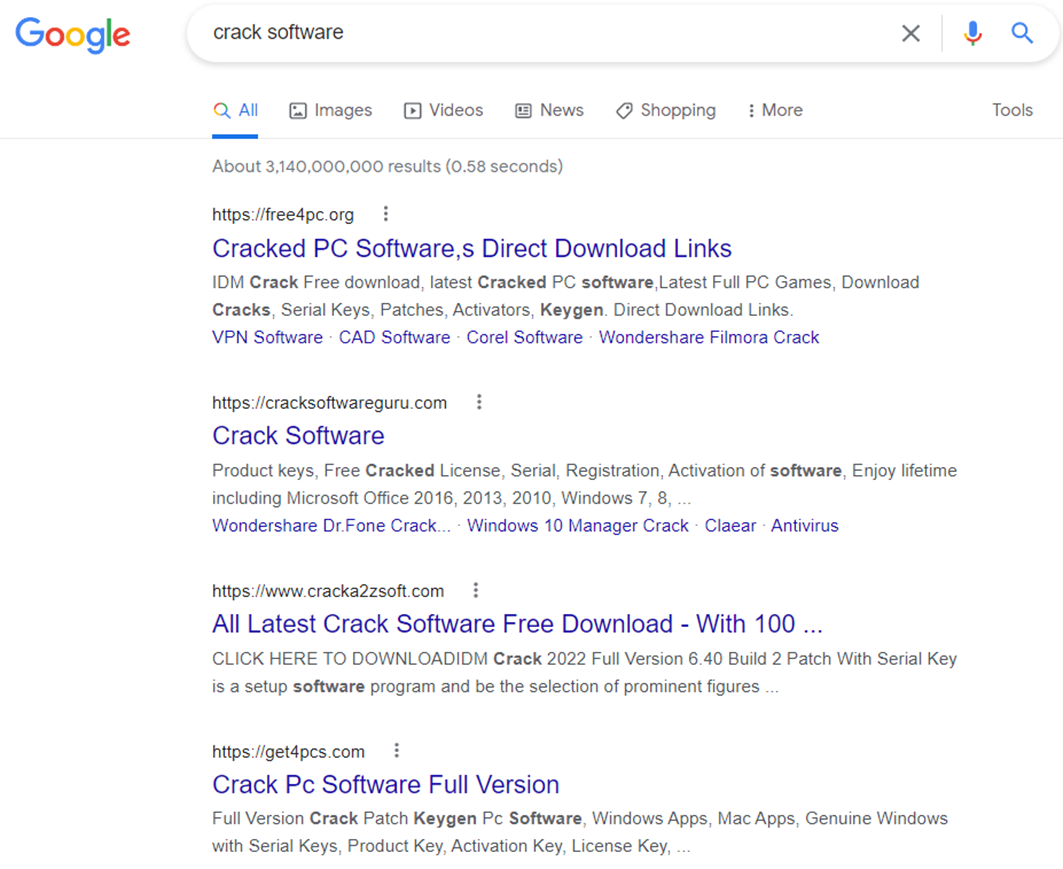

Only Buy from Legitimate Sources

First and foremost, you should only buy from legitimate sources. That means companies that have a good reputation and that you can trust. If you’re not sure about a company, do some research online or ask around to see if anyone has heard of them. If in any doubt whatsoever, don’t make the purchase.

Check for SSL Certificates

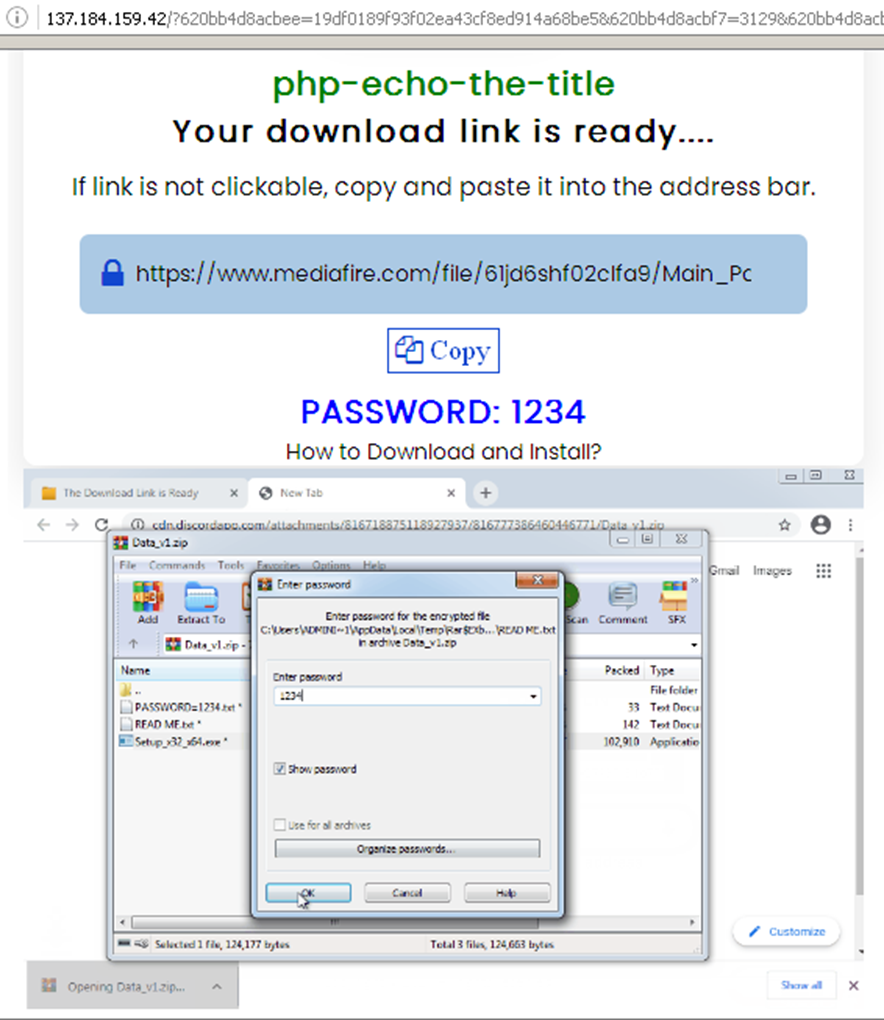

When you’re on a website where you’re about to make a purchase, take a look at the URL in the address bar. If it starts with “HTTPS” instead of just “HTTP,” that means the site has a secure connection. That’s important because it means any information you enter on the site (including your credit card number) is encrypted and less likely to be intercepted by someone who shouldn’t have it.

HTTPS is short for “Hypertext Transfer Protocol Secure.” It’s the same thing as regular ol’ Hypertext Transfer Protocol (the stuff that makes the internet work), with the addition of security. When you connect to a website using SSL, your computer contacts the website’s server and asks it for its SSL certificate.

Another way to check for an SSL certificate is to look for a lock icon in your browser’s address bar; the padlock means the connection between you and the site is secure.

Check the Terminal

If you’re buying something over the phone and reading out your details, be sure to check the terminal that the business is using. For example, an EFTPOS POS machine is one of the most reliable and secure systems around. When businesses use these machines for manual transactions, you can be sure…