Suffolk cyberattack: County consultant also lobbies for vendor hired to fortify system

A consulting firm hired to help manage Suffolk County’s response to a ransomware attack also has served as a lobbyist for the computer security company brought in more than three years ago to analyze and fortify Suffolk’s networks, according to a Newsday analysis of records.

Computer security experts and a government watchdog group said consulting firm RedLand Strategies and founder Michael Balboni’s roles as state lobbyist for the company — and consultant to Suffolk County — could present potential conflicts of interest in the cleanup of the Sept. 8 cyberattack.

Separately, computer experts raised concerns that Palo Alto Networks, the company that provided the front-line firewall of Suffolk’s defense against cyberattacks, is acting as the primary forensic auditor to analyze what happened when the county’s system was breached.

RedLand and Palo Alto, both responsible for helping safeguard Suffolk’s computer system since 2019, recently were awarded new contracts to manage the county’s response to the attack, determine how the breach occurred and to help fix it.

WHAT TO KNOW

- A consultant brought in to help manage Suffolk’s response to the Sept. 8 ransomware attack also has served as a lobbyist for a security system vendor that provided Suffolk’s front line of defense.

- Good government experts say the roles could present a conflict, but others say the current state of emergency and continuing impacts warrant the measures.

- An annual computer network risk-assessment report required by 2018 legislation has been finished only once, and a top recommendation to hire a cybersecurity chief wasn’t followed.

- Experts say the county should look to independent forensic auditors to conduct a thorough investigation of the cyber breach, rather than use an arm of the firewall company.

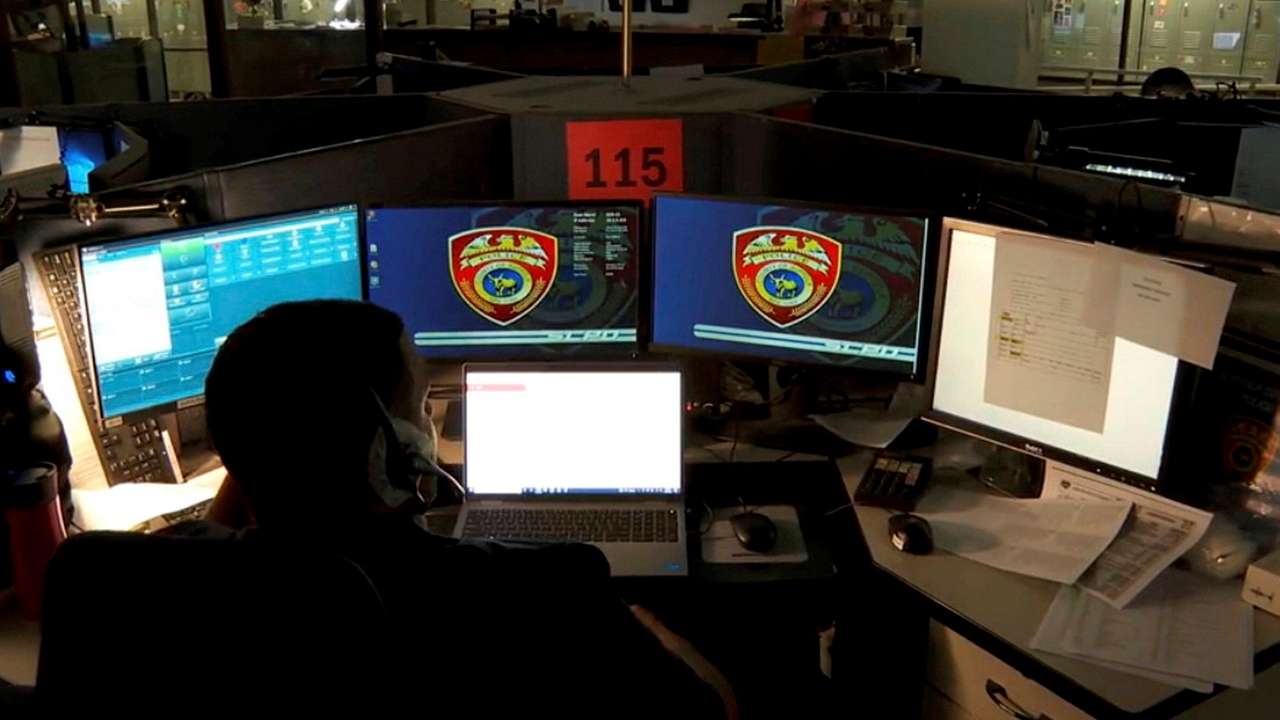

Suffolk has yet to publicly say how ransomware attackers infiltrated its system — potentially hundreds of times in the days and weeks leading up to the attack — but no one is blaming RedLand or Palo Alto. The attack has hobbled telephone and email systems and impacted the police department, Department of Health Services, and the Traffic and Parking Violations Agency as the…