Get 6 Months of Amazon Prime When You Buy an O2 Phone Plan

If you take out a new pay monthly, SIM-only, or Volt bundle on O2, or are upgrading to one, then you can get six months of Amazon Prime for free.

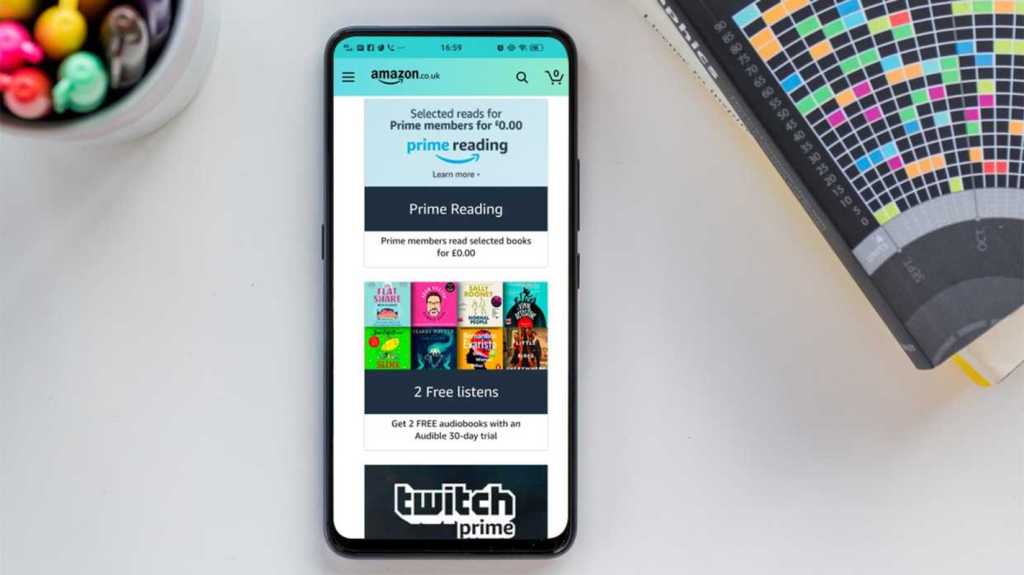

The extra can be added onto any plan bought on the O2 website or claimed within the first 28 days of the contract. Amazon Prime offers one-day and same-day delivery, Prime Video, Amazon Music, e-books and access to flash sales such as Prime Day.

To get the extra, simply add the contract that you want to your basket by clicking ‘Choose this plan’, and then under the ‘Your extra’ section, choose ‘Get six months of Amazon Prime, on us’.

After the six months are up, the subscription reverts to the standard price of £8.99 per month – though customers can cancel before having to pay.

If you’re an existing O2 customer, then you can’t get Prime for free. However, if you add it to your plan then you can get £2 off your monthly airtime bill.

Besides Amazon Prime, new O2 customers also have the alternative option of signing up for six months of the following services: Disney+, Audible, McAfee Mobile Security Plus, Amazon Music Unlimited and Cafeyn. Only one free extra can be claimed on an O2 bill.

Now is a good time to look at O2 plans, as the carrier is offering some big deals, including up to £180 off the airtime cost of the iPhone 14 Pro 128GB on an Unlimited tariff and up to £288 off the Google Pixel 6a on multiple plans.

O2 also has a cracking SIM-only offer – you can get three months free when you take out either the Unlimited SIM-only Plus Plan from £30 per month or the 150GB SIM only deal for £22 per month.

US readers can also bundle in an Amazon Prime subscription with their phone contract if they sign up for a plan with Metro by T-Mobile.

You can find more offers in our monthly best SIM-only deals roundup.