Here are 7 back-to-school shopping tips you need to know

Seems too soon but, school will be starting for thousands of students. While signaling the end of summer it also signals the start of back-to-school scams. Recently, in a news release the Better Business Bureau warned that, “Parents should be on the lookout for back-to-school scams this year because of inflation and product shortages.”

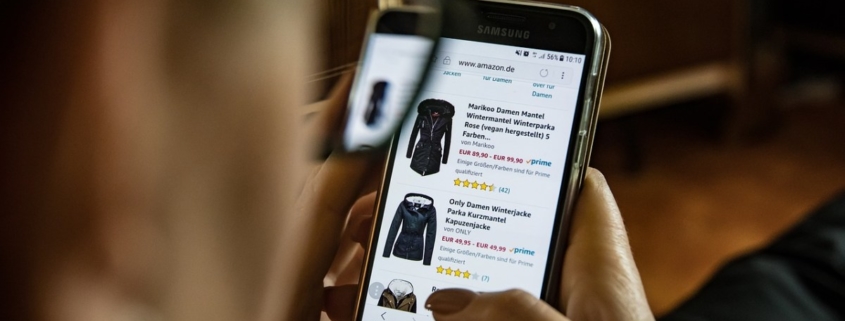

Parents are certainly going to turn to online shopping, and con artists will come up with new angles to take advantage of the mad rush for high-demand products. Scammers will target shoppers with phony deals, enticing ads, and attractive, but fake, websites.

Using figures from National Retail Federation as a gauge, shoppers are expected to spend an average of $864 per family. Spending for families with college-age students is pegged at $1,199. Overall family spending will top $37 billion dollars while college students’ families will spend more than $70 billion. For scammers those numbers are too big to ignore.

The cons the crooks are running are generally plays on the same schemes they use throughout the year. According to McAfee a computer security software company parents need to be concerned about:

- Identity theft – Because school aged children have clean Social Security numbers and credit reports that are rarely checked. Be cautious when asked for identity information to register for sports leagues and after school events.

- Phony tuition fees – “Save your spot” emails are sent requesting a tuition fee. These emails can cause confusion for parents who may have already paid tuition but without questioning will make a second payment.

- Financial aid fraud – Con artist advertise a service – for a fee – to secure financial aid. When the application is completed, you can lose both your money and personal and financial information.

- Student loan forgiveness – Ads found on social media and from emails offering to assist in getting student loans forgiven. The scammers charge exorbitant fees to renegotiate the debt.

- Phony student taxes – A twist on the IRS scam, text messages, emails and phone calls that claim to be from the IRS with a demand for immediate payment of the “Federal Student Tax” or risk jail time.

Millions will be spent on…